Trend Vigor

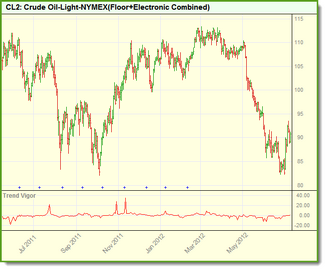

The strength of the trend as measured over the dominant cycle. Trend Vigor is defined as the momentum over the dominant cycle period divided by the amplitude of the dominant cycle.

Ehlers suggests trend trades should only be taken when the trend vigor is > +1 for longs and < -1 for shorts.

The trend vigor indicator is not the same as the Relative Vigor Index (RVI). Trend Vigor measures the strength of the trend relative to the cycle. The larger the value of the Trend Vigor, the more powerful the trend is relative to the cycle. Trend Vigor, as best I can recall, was first mentioned in Ehlers November 2008 article "Corona Charts".

The trend vigor is the slope of the close (or any other price input) over one full dominant cycle divided by the amplitude of the dominant cycle.

Example Approach: |

|---|

offset = measured dominant cycle

The Inphase and Quadrature are components derived when calculating the dominant cycle. Detailed discussion of the InPhase and Quadrature components can be found in Ehler's book, "Rocket Science for Traders" in the chapter discussing the Homodyne Discriminator dominant cycle calculation. |

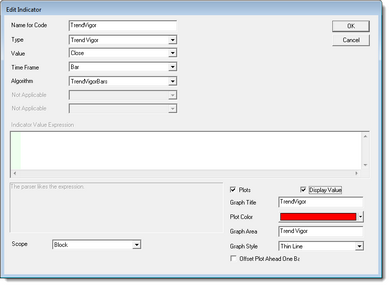

Indicator Settings:

Parameter: |

Description: |

|---|---|

TrendVigorBars |

Number of price-bars to use in the Trend Vigor calculation. |

Links: |

|---|

Basic Indicators, Calculated Indicators, Creating Indicators, Custom Indicators, Indicator Access, Indicator Reference |

See Also: |

Edit Time: 9/26/2020 1:21:17 PM |

Topic ID#: 635 |