Market Specifications

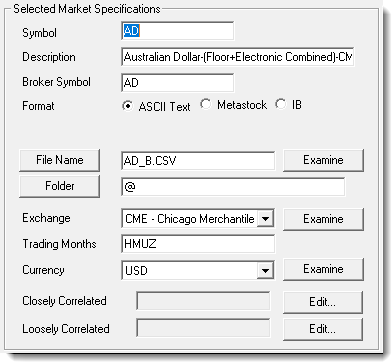

The editor uses the Market Specification controls to select an instrument in the current Futures Dictionary to review and edit. When a symbol is entered and displayed in the "Symbol" field, the contract's exchange values are displayed in the "Futures Market Symbol Values" details display Selected markets display their specification details in the Symbol Specification Table.

Market Specification Editing & Futures Symbol Specification Table:

Editor Item Name: |

Description: |

||

|---|---|---|---|

Symbol: ^Top |

The symbol for the market. The symbol in a futures portfolio must match this symbol. |

||

Description: ^Top |

The name of the market longhand. |

||

Broker Symbol: ^Top |

The symbol used by your broker for this market. |

||

Data Format: ^Top |

The data format: ASCII or MetaStock. |

||

File Name: ^Top

|

This is the actual file name of the data file that will be linked to this symbol. Press the File Name button to locate the file using a browser interface.

|

||

Folder Location: ^Top

|

This is the actual folder location of the data file. Press on the Folder Location button to locate the folder using a browser interface. The "@" sign is used to represent the default data folder as set in preferences. In this way the Dictionary is transportable to another installation of Trading Blox. If you hard code the folder location using C:/xxx then it will not be transportable, but you can specify any location even outside of the Trading Blox folder or the default data folder as set in preferences.

|

||

Exchange: ^Top

|

The exchange that the market trades on.

|

||

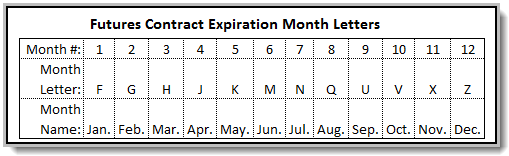

Trading Months: ^Top |

The months that the market trades using standard futures month letters. This is used to determine how many times per year account for contract rolls, when you have the Account for Contract Rolls global parameter set to true. The more months you have here, the more times the system will simulate a roll, and account for commission and slippage. Note that if you have the delivery month in your data, then this is not used at all. But if you don't have the delivery month in your data, and you want to account for contract rolls, a roll we be assumed every x bars where x is 250 divided by the number of months entered here. Good for daily data, but not for intraday or weekly data.

|

||

Currency: ^Top

|

The ISO Currency Code that the contract is denominated in. U.S. markets are denominated in USD, European markets are generally denominated in either USD - U.S. Dollars, GBP - British Pounds or EUR - EEC Euros.

If you select a currency other than the system wide base currency, the system will use the corresponding Forex file to convert the prices into the system wide base currency. So you can test futures with different currencies in one test, and the results will all be in the system wide base currency. You should enter the Big Point Value and Margin in the foreign currency, since the system will convert these into the system wide base currency for you.

If your system wide base currency is USD, and you select EUR as the currency, the system will look for the EURUSD Forex file and assume it is in the format USD per EUR. If it does not find this file, it will look for USDEUR and assume it is in the format EUR per USD.

If you want to reverse the way the system uses these files, you can check "Reverse Conversion" in the Forex Dictionary.

|

||

Closely Correlated: ^Top |

The markets which closely correlate to the given market. Clicking on the Edit button will bring up an editor which allows you to select that markets which closely correlate to a particular market. |

||

Loosely Correlated: ^Top |

The markets which loosely correlate to the given market. Clicking on the Edit button will bring up an editor which allows you to select that markets which loosely correlate to a particular market. |

Futures Symbol Specifications: ^Top

Futures Market Selected Symbol Values

Editor Item Name: |

Description: |

|---|---|

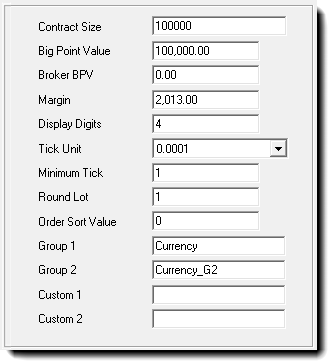

Contract Size: ^Top |

|

Big Point Value: ^Top |

The value of a 1.0 price movement (see Determining Big Point Value for a detailed explanation). The Big Point Value should be expressed in the currency of the underlying contract. |

Broker BPV: ^Top |

Brokers BPV, when it is different from the published BPV. |

Margin: ^Top |

The margin used to simulate margin calls while testing. |

Display Digits: ^Top |

The number of significant decimal digits displayed for this market. |

Tick Unit: ^Top |

The unit of the tick. This is either a decimal like 1.0, 0.1, 0.01, etc. or a fraction like 1/4, 1/8, 1/32 etc. |

Minimum Tick: ^Top |

The number of tick units which constitutes a minimum tick. For example, if the minimum tick is 0.025 or twenty five thousands, the tick unit is thousandths, 0.001 and the minimum tick value is 25. |

Round Lot: ^Top |

The round lot for trading. If you enter a value of 100 here, Trading Blox will only trade in increments of 100. |

Order Sort Value: ^Top |

This value determines the sort order of the markets for order generation. The sample data sets these values to a number corresponding to the market open time using U.S. Eastern Standard Time. This results in order files that are in the same order as the market open. For example, the 820 cited above for AD - Australian Dollars corresponds to the 8:20 AM market opening of the AD on the Chicago Mercantile Exchange. |

Group 1: ^Top |

This string is the group1 to which the market belongs. It can be any string or number, up to 32 characters. When more than one market have the same group, you can access certain instrument properties in scripting such as group margin and group risk, etc. |

Group 2: ^Top |

This string is the group2 to which the market belongs. It can be any string or number, up to 32 characters. When more than one market have the same group, you can access certain instrument properties in scripting such as group margin and group risk, etc. |

Links: |

|---|

|

See Also: |

|

Edit Time: 9/12/2020 2:21:47 PM |

Topic ID#: 246 |