Equity Manager

The following is a comprehensive list of the Trading Blox global Equity Management parameters, and an explanation of how each is used. The Test Parameter values can be viewed and changed at the bottom of the Suite Parameters tab that is attached to every suite.

Allocation Equity Calculation:

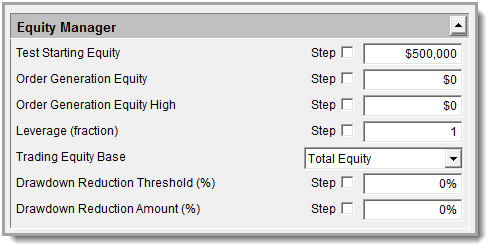

Equity Manager area in the Global Parameters section sets basis for how much can be allocated to a system:

Property Name: |

Description: |

|||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Test Starting Equity: ^Top |

This parameter sets the currency value of the account balance at the start of the simulation (at this point Closed Equity = Total Equity). It is an initial value only. Trading Blox internally recalculates the various running account balances daily, for the duration of the simulation.

When generating orders, Trading Blox uses the Starting Balance to calculate the number of shares or contracts for each order. In order to make sure that the order sizes are accurate, the Starting Balance value should be updated daily using actual trading account balances. The Starting Balance for orders should be set to the value corresponding to the Trading Equity Base parameter (see below). For Total Equity use the actual current daily account values. |

|||||||||||||||||||||||||||||||||||

Order Generation Equity: ^Top |

When generating orders, the system first runs a test based on the Global Equity Settings. Let's say you start with $100,000 and end with $150,000 over the course of the test. However, to generate orders your actual account may have a different amount. Perhaps you added money to your account, or made a withdrawal. If you want your orders to reflect your account balance, enter it here. This is only used for Order Generation. It controls the amount of equity available for trading on the order generation date. |

|||||||||||||||||||||||||||||||||||

Order Generation Equity High: ^Top |

Works in concert with Starting Balance (see previous). NOTE: This parameter was designed predominantly for use when generating orders, and is of consequence only if you are using the Drawdown Reduction Threshold (DRT) and Drawdown Reduction Amount (DRA) parameters (see Equity Management Parameters). |

|||||||||||||||||||||||||||||||||||

Leverage: ^Top |

While this parameter was designed primarily to allow simulations of stock margin accounts, it can also be used to adjust the leverage of futures trading. Since the leverage available in a futures account is already quite large, this parameter should generally be set to a value of one or less for futures testing.

Lending institutions may lend funds that can be used to leverage your investments. If a lending institution agrees to lend you some amount for every amount of existing account equity, then in Trading Blox the Trading Equity (the total money available for trading) would be twice the amount of equity corresponding to the Equity Base parameter. Assuming Equity Base is set to "Closed Equity", this corresponds to a Leverage value of 2, with the actual trading equity equal to twice the Closed Equity at any point in time. If no money was available from lending institutions, then the trading equity would equal Closed Equity, and the value of Leverage would be 1.

Trading Equity = Leverage x Account Equity

For example, if Leverage is increased from a value of 1 to a value of 2, and position sizing parameters remain unchanged, then orders will be sized twice as large.

Leverage can also be set to a fractional value. Setting Leverage to a value of 0.50, for instance, will simulate allocating 50% of your account to cash. |

|||||||||||||||||||||||||||||||||||

Trading Equity Base: ^Top |

The Trading Equity Base parameter can have one of two separate values:

The value of the Trading Equity Base defines the available Trading Equity. Trading Equity is the equity figure used for all money management position sizing calculations and for determining the maximum amount of equity that can be used for margin or purchasing stocks.

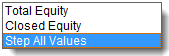

You can step the Trading Equity Base parameter by selecting the Step All Values item.

This will result in two separate runs, one each for Total Equity and Closed Equity. |

|||||||||||||||||||||||||||||||||||

Drawdown Reduction Threshold: ^Top |

This parameter and the one that follows allow simulation of the Turtle risk-management rules. They work in concert to reduce the likelihood of dramatic losses by cushioning equity drawdowns. While these parameters and the associated risk management algorithms were designed to support the Turtle System they can also be used with other systems

Drawdown Reduction Threshold (DRT) defines the drawdown point at which the amount of money available for trading is reduced. For example, if DRT is set to 10%, then when a 10% drawdown is incurred, trading equity will be reduced by the percentage specified for the following parameter, Drawdown Reduction Amount (DRA).

If you wish to eliminate the effect of DRA entirely, then set the value of DRT to 100% and the DRA to 0%.

The drawdown utilized by DRT is always measured from the most recent Closed Equity peak, and is calculated based on the Closed Equity. |

|||||||||||||||||||||||||||||||||||

Drawdown Reduction Amount: ^Top |

Works in concert with Drawdown Reduction Threshold (DRT), above. Drawdown Reduction Amount (DRA) specifies the percentage by which Closed Equity is reduced in the event of a drawdown of the magnitude specified by the DRT parameter.

This parameter pair only affects the sizing of (and the capital available for) new trades. It does not modulate the size of existing positions.

The table below is based on the default Turtles settings of 10% for DRT and 20% for DRA, and shows how DRT and DRA work together to reduce the equity available for investment during periods of drawdown.

As is shown, Available Equity = Actual Closed Equity * (1 - DRA). In this example, the most recent Closed Equity high (the peak from which drawdown is measured), is $1,000,000. In Trading Blox 2.0.10, DRA is calculated such that you will never get a zero or negative equity amount. In this way you can test a 90% DRA if you wish.

When actual closed equity drops by 10% (to $900,000), the Drawdown Reduction Threshold is violated, and DRA kicks in, reducing the equity available for investment to $720,000 (actual closed equity less 20%). Now, any new trades-instead of being sized to the actual closed equity figure of $900,000-will be sized based on the available equity of $720,000.

DRT and DRA operate in a step-wise fashion: While equity fluctuates below $900,000 but above $800,000 positions will continue to be sized based on the available equity of $720,000.

The effect of DRT and DRA is cumulative (exponential not geometric): If the actual equity falls an additional 10%, to $800,000 (a 20% drawdown as measured from the previous equity peak of $1,000,000), then available equity is reduced further to $512,000 or 64% of actual equity. The process continues as the drawdown steepens.

DRT and DRA work symmetrically as the account begins to climb out of the drawdown, and have no further effect between the time the actual account equity exceeds the original Drawdown Reduction Threshold of $900,000 and a new equity high is achieved. If the current drawdown should re-commence before a new equity high occurs, then DRA will kick in again at $900,000. |

|||||||||||||||||||||||||||||||||||

Notes: oWhenever a new Closed Equity high is achieved, DRT and DRA sit idle, waiting for the next 10% drawdown (or other user-specified DRT value) to occur. oWhen running historical simulation tests, the starting Account Balance is treated as an equity high when the simulation commences, unless the value of Account High has been set even higher (see Starting Balance and Account High, next). oDRA is active only during drawdowns whose magnitude exceeds the percentage specified by DRT. So if DRT is set to a large value, it is possible that its threshold will never be violated. If DRT is set to 100%, or if DRA is set to 0%, then the effect of this parameter pair is completely disabled. oIf the values of DRT and DRA remain static, while Percent Risk per Trade is increased (i.e. as the percentage of equity risked on each trade is increased and drawdowns are magnified), then DRT will be triggered more frequently, and DRA's effect on performance will be more profound. oDuring very large drawdowns (particularly those that occur near the start of a simulation), it is possible that available account equity-having been dramatically reduced by the effect of DRA-will be insufficient to allow new trades to be put on, particularly for futures. At this point, trading will cease. oThe drawdown utilized by DRT is always measured from the most recent Closed Equity peak, and is calculated based on the Closed Equity high. |

Edit Time: 2/18/2022 3:35:42 PM |

Topic ID#: 134 |