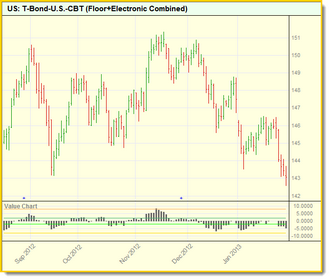

ValueChart

Volatility adjusted overbought/oversold oscillator. Value chart levels between -4 and +4 are considered “fair value”; +4 to +8 moderately overbought; -4 to -8 moderately oversold. Levels above +8 are considered significantly overbought and below -8 significantly oversold.

Value Charts are discussed in the book “Dynamic Trading Indicators” by Mark W. Helweg & David C. Stendahl.

Syntax: |

|---|

ValueChart ( series, bars ) |

Parameter: |

Description: |

|---|---|

series |

Name of the series. The series must be one of Instrument.High, Instrument.Low, Instrument.Close, Instrument.Open. |

bars |

The number of bars over which to find the value chart level. |

Notes:

In copyright publication dated 2002 Value Charts are described on page 127 to 145.

Book uses the value of the Value Chart return to decide if a bar on the chart qualifies for a signal.

Returns: |

|---|

The value chart level over the specified number of bars. |

Example: |

|---|

' ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

|

Chart Display: |

Links: |

|---|

See Also: |

|---|

Edit Time: 9/26/2020 1:32:55 PM |

Topic ID#: 644 |