Operating Overview

Trading Blox system construction begins when an existing suite is edited or a new suite is created. Suites can have one or more suites and they can also have their own Blox. Suites are the foundation component that allows systems to be tested. Suites can have a single system, or it can have multiple systems. When multiple systems are attached to a suite each system will be tested in alphabetical order of each system name selected to be tested in the selected suite name. To change the order in which systems are selected before the other systems, just change the names so the systems arrange their order when the system names are sorted alphabetical order.

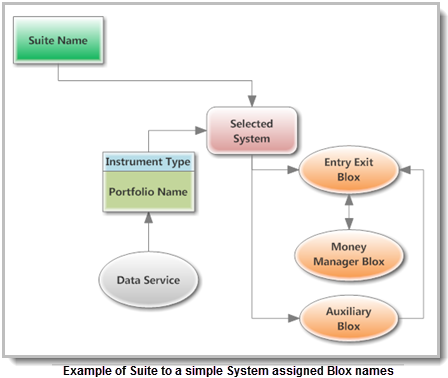

In the image example shown above, the structure shows a simple outline of the basic components that can be part of a system listing.

The top of a test is the suite name. Below that level there must be at least one system name. In the system structure there must be at least one blox name and a portfolio name. Other blox names can be added, and when a trading idea is to be tested there are other requirements (see below) . Trading idea examples available for testing are included during installation. There are no practical limits on the number of suite or system names that can be added to Trading Blox.

Within a Suite, the selected system name(s) determines the testing process. Suite names with a selected system can be edited so that a different system or a group of systems can be tested. System names can also have their selection of blox changed so that edited system performs a test in a different way.

When working with one or more system names in a suite name, each system must have a portfolio name selected. If the test is to create results of a trading idea, that system must also have an amount of equity available to support the orders, and there must be a Money Manager selected to size the positions when the orders are filled. Systems not intended to trade will still need access to a portfolio, which can be just one, or multiple symbols, but all systems used to generate after test performance must have a Money Manager.

Portfolio names determine what symbols to test for the after test information report. Trading Blox allows portfolios for three different instrument classes. Each instrument class supported allows systems to test different trade ideas for Futures, Forex, and Stock type instruments like Stocks, ETF and Mutual Funds. When multiple systems are selected in a suite, each system in a suite can test a different type of instruments using trading ideas for that type of instrument class. This also means when there are three systems selected in a suite name, each system can perform a test in each of three different instrument classes available.

When a system name is created, or edited, there is usually a trading idea in mind. When this idea is to perform trading results, the blox selected in a system will need to have blox names that can perform the task expected and can support some phase of the trading idea. To help the user get started with understanding how to test trading ideas, Trading Blox installs a sample suite name and a group of system names that represent some of the popular trading ideas. Each of the well-known trading systems installed with Trading Blox will use a different trading idea in its testing. Some trading ideas are more suited to one type of instrument class than another instrument class. All the supplied systems can be modified, and all will allow their blox to be viewed and edited.

Trading System Construction:

Each supplied system can be used as installed, or it can be changed and adjusted as needed. For example, each system's default parameters can be changed, or other Blox methods can be added or changed. Parameter values can be automatically changed when the Step option is made available near the parameter's entry field, or in the drop-down list. When Step is enabled the user can enter a starting and ending value and a value of how much to change on each step.

Once a particular combination of parameter values has been tested and found to produce acceptable results that system can be traded so the orders it generates can be used with a broker. Orders are generated when "Generate Orders" button on the main screen is clicked, or when the F7 key is pressed. With the click of the mouse, Trading Blox will generate a report of the current active positions and the next day's orders.

If any of a system's input parameters are changed those changed values will appear the next time that system is selected. Parameter setting values that appear at the time of a test are the values used to control how the system operates. However, some of these parameters have nothing to do with the system's design rules. For example, the test start and end date values entered, or the list of markets in the selected portfolio. Most other menu displayed parameters affect how the system works, such as the number of days used to calculate a moving average. Global parameters can effect a system performance result. For example, commission and slippage can reduce the profits and increase trading cost. Margin limits can limit how many trades are allowed, and amount of equity available can cause some orders to be rejected. Global parameters are saved with the Suite file name when a different suite name is selected or your exit the software.

At Trading Blox, we understand that any trading system is only as good as the consistency with which it is applied. By harnessing the speed and reliability of modern-day computer hardware, Trading Blox significantly reduces the effort required to test and to trade a system, while eliminating the possibility of human error and missed trades. And therein lies its greatest strength: Trading Blox makes it easier to follow the trading systems you develop. At the heart of Trading Blox ability to help you build a successful trading strategy is its ability to test a large portfolio of instrument in a single test.

Supplied Suite:

oTest Suite

Installed Trading Systems:

oADX System

oATR Channel Breakout

oBollinger Breakout

oBollinger Counter Trend

oChart

oDonchian w Rule Labels

oDonchian

oDual Moving Average

oMACD System

oRSI Trend Catcher

oStochastic System

oTriple Moving Average

oTurtle

Edit Time: 9/12/2020 9:50:00 AM |

Topic ID#: 180 |