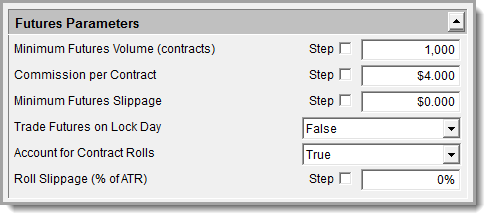

Futures Parameters

All Futures contract instrument order transaction cost are controlled by the settings in this section.

Global Parameter: |

Description: |

|

|---|---|---|

Minimum Futures Volume (contracts) ^Top |

This parameter applies only to futures. It establishes the minimum daily trading volume, in contracts, required to enter a futures position. It is based on a 5-day exponential moving average of the volume. This value can be viewed by using the instrument.averageVolume property when using the Builder Edition. |

|

Commission per Contract ^Top |

This parameter indicates the round-trip charge for each futures contract traded. Assuming a Commission per Contract of $12.50, buying and then subsequently selling 1,000 contracts of sugar would result in a total transaction cost of ($12.50 per contract) x (1,000 contracts) = $12,500. |

|

Minimum Futures Slippage ^Top |

|

|

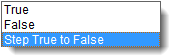

Trade Futures on Lock Day ^Top |

When this parameter is set to false, the simulation will not fill entry or exit orders on days when the high = low, when the trade is in the direction of the lock. The idea is that in futures this could be a lock limit day, and it would be the most conservative assumption to assume you did not get filled.

If you set this parameter to true, you will be filled on these days. This applies to futures only.

Example: With this parameter set to false, and the high equals the low, so it is considered a lock day. If you want to enter long, or exit a short position, and the close of the lock day is less than the close of yesterday, then it will be allowed. But if the close of the lock day is greater than or equal to the close of yesterday, then the fill will be denied. |

|

|

Roll Slippage (% of ATR) ^Top |

|

This parameter applies only to futures, and it controls whether or not Trading Blox should account for the increased commission and slippage that would have resulted when rolling contracts when a position is held for a long period of time.

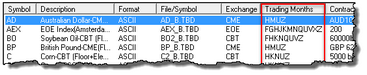

When your data includes the Delivery Month for your futures contracts, Trading Blox roll will account for your roll transactions when the value in the Delivery Month column changes the expiration month assigned to data record.

When the Delivery Month column is missing from your futures contract data files, Trading Blox will roll every time the delivery month changes in relationship to the data record used in a position. Contract rolls will happen using the contract expiration month letters displayed is the Futures Dictionary's Trading Months column. Rolls when Delivery Month Column is Missing: If there are 4 trading months, then Trading Blox will calculate a contract roll every 3 months. If there are 12 trading months, Trading Blox will calculate a contract roll every month. The first simulated roll will occur in 1/2 the normal roll frequency because, on average, the first contract will be entered with 1/2 its trading life left. This process is based on calendar days and works for intraday, daily, weekly, or monthly data.

Roll Slippage Calculation Basis: Each time a simulated roll occurs, Trading Blox accounts for the roll by deducting slippage and commissions for each contract in the position. The Open Equity is moved to Close Equity. If the futures is non-USD denominated, the currency conversion for the roll date will be used to move profit from open equity to closed. This adjustment locks the the profit in at the conversion rate of the roll.

Slippage Percentage has more calculation details: |

When the Account for Contract Rolls option is set to True, all Futures will Account for Contract Rolls using the slippage rate entered into the Roll Slippage (% of ATR) field.

The roll slippage percent is based upon the Wilder 20-day ATR (39 day non SMA primed Exponential Moving Average of the True Range). This is an un-primed value that can be accessed by the instrument.defaultAverageTrueRange property. |

||

Edit Time: 9/12/2020 9:50:00 AM |

Topic ID#: 146 |