MACD System

The Moving Average Convergence/Divergence indicator is a centered oscillator that shows the difference between two moving averages, typically 12 and 26 days. These values, like any other parameter, can be altered to show the MACD over a different period of time.

The MACD system buys when the MACD goes above zero and sells when it goes below zero. So it's always in the market. Very similar in function to the Dual Moving Average System.

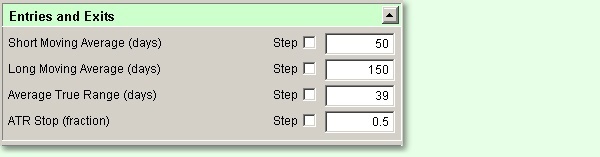

The MACD system uses the following parameters:

Short Moving Average Days

Number of days used to calculate the short moving average

Long Moving Average Days

Number of days used to calculate the long moving average

Average True Range Days

Number of days used to calculate the Average True Range

ATR Stop

ATR Stop (fraction): Fraction of the ATR used for stops

Entry Script

IF macdIndicator > 0 AND

instrument.position <> LONG THEN

IF useATRStops THEN

broker.EnterLongOnOpen( instrument.close - averageTrueRange * atrStop )

ELSE

broker.EnterLongOnOpen

ENDIF

ENDIF

IF macdIndicator < 0 AND

instrument.position <> SHORT THEN

IF useATRStops THEN

broker.EnterShortOnOpen( instrument.close + averageTrueRange * atrStop )

ELSE

broker.EnterShortOnOpen

ENDIF

ENDIF

Adjust Stops

' ---------------------------------------------

' Enter stop if "holdstops" is true

' ---------------------------------------------

IF useATRStops THEN

broker.ExitAllUnitsOnStop( instrument.unitExitStop )

ENDIF

Edit Time: 9/12/2020 9:50:00 AM |

Topic ID#: 165 |