ADX System

The Average Directional Index (ADX) was developed by J. Welles Wilder to help traders determine the strength of the trend. Two components that help you determine the direction of the trend are the Positive Directional Indicator (+DI) and Negative Directional Indicator (-DI).

The built-in ADX System uses two factors to signal and entry:

•The strength of the trend (ADX) needs to be greater than a certain threshold

•The cross over of the +DI and -DI

It uses a fraction of the ATR plus/minus the close to set the stop price.

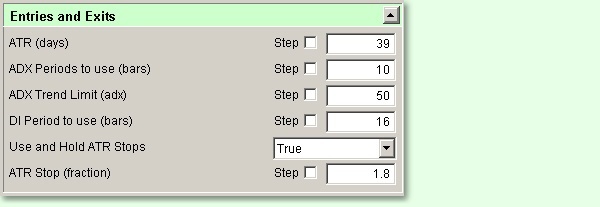

The ADX System uses the following parameters:

Average True Range (days)

Sets the number of days to use when calculating the Average True Range

ATR Stop (fraction)

Sets the fraction (.5, 1.5, 3) of ATR to use for the stop width

ADX Periods to use (bars)

Sets the number of bars to use in calculating the ADX

ADX Trend Limit (adx)

Sets the minimum threshold for entering a trade

DI Period to use (bars)

Sets the number of bars to use in calculating the +DI and -DI

Entry Script

IF adxIndicator > adxTrendLimit AND

positiveDirectionalIndicator > negativeDirectionalIndicator AND

instrument.position <> LONG THEN

IF useATRStops THEN

broker.EnterLongOnOpen( instrument.close - averageTrueRange * atrStop )

ELSE

broker.EnterLongOnOpen

ENDIF

ENDIF

IF adxIndicator > adxTrendLimit AND

positiveDirectionalIndicator < negativeDirectionalIndicator AND

instrument.position <> SHORT THEN

IF useATRStops THEN

broker.EnterShortOnOpen( instrument.close + averageTrueRange * atrStop )

ELSE

broker.EnterShortOnOpen

ENDIF

ENDIF

Adjust Stops

' ---------------------------------------------

' Enter stop if "Use ATR Stops" is true

' ---------------------------------------------

IF useATRStops THEN

broker.ExitAllUnitsOnStop( instrument.unitExitStop )

ENDIF

Edit Time: 9/12/2020 9:50:00 AM |

Topic ID#: 103 |