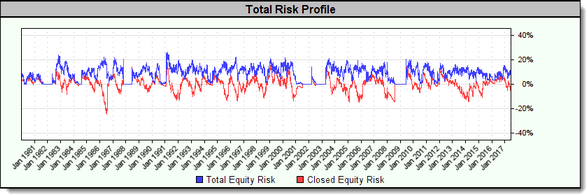

Total Risk Profile Graph

Total Risk examines the relationship between Total Equity and Closed Equity to Open Risk (respectively). The Total Risk Profile graph displays Total Equity Risk and Closed Trade Risk plotted over time.

The following definitions will help illustrate the difference between Total Equity and Closed Equity risk.

Property Name: |

Definitions: |

|---|---|

Closed Equity |

Starting Balance plus the cumulative profit (or loss) from all closed-out trades. (Sometimes referred to as Closed Trade Equity.) |

Open Equity |

Total profit (or loss) of all open positions. |

Total Equity |

Closed Equity + Open Equity |

Open Risk |

The (currency) distance from the current price to the closest stop, for all open positions. It is based on the assumption that all open positions will be exited at their current designated stops (though some or all of these positions may prove profitable in the future). |

Closed Risk |

The (currency) distance from the entry price to the closest stop (either entry or trailing), for all open positions. If the trailing stop is profitable then the closed risk on a position is zero. |

Locked-In Profits |

Open Equity - Open Risk. (The profit on a trade in progress becomes "locked-in" when the trailing stop moves favorably past the entry price.) |

Total Equity Risk |

Open Risk / Total Equity |

Closed Equity Risk |

Closed Risk / Closed Equity |

Consider the following example of Total Equity Risk:

Total Equity |

$150,000 |

Closed Equity |

$100,000 |

Open Equity |

$50,000 |

Open Risk |

$40,000 |

Locked-in Profits |

$10,000 |

Closed Risk |

$0 |

Total Equity Risk |

Open Risk / Total Equity = $40,000 / $150,000 = 26.67% |

Closed Equity Risk, while similar to Total Equity Risk, is impacted only by locked-in losses (Thus, it is 0% in the example above). The plot of Closed Equity Risk will only assume a positive value when Closed Risk is positive. Closed Risk is positive when the Locked-In Profits are less than zero. If there are Locked-In Profits then the Closed Risk is zero and the Closed Equity Risk is zero.

Now consider how Closed Equity Risk differs:

Total Equity |

$150,000 |

Closed Equity |

$100,000 |

Open Equity |

$50,000 |

Open Risk |

$60,000 |

Locked-in Profits |

-$10,000 |

Closed Risk |

$10,000 |

Closed Equity Risk |

Closed Risk / Closed Equity = $10,000 / $100,000 = 10.00% |

Edit Time: 2/18/2022 3:35:42 PM |

Topic ID#: 4005 |