Page 1 of 1

Asymmetry and the Short Side

Posted: Thu Sep 23, 2004 7:26 pm

by shakyamuni

What methods do you find to be most effective for capitalizing on the short side of the equity market?

Posted: Fri Sep 24, 2004 9:38 am

by Forum Mgmnt

I've found that the price action on the short side is sufficiently different with stocks that I wouldn't even consider a symetric long/short system.

So different that completely different strategies make sense to me and that is what I do in my research.

- Forum Mgmnt

Posted: Wed Jun 20, 2007 9:18 pm

by geek2908

I have found that plotting trend duration, the graph is skewed to the right, i.e. the stock market (using SPY as a proxy) doesn't tend to trend downward but drops in short bursts. Of course, there are some long downward trends, and if you can find one, it can be profitable.

Trend persistence

Posted: Thu Jun 21, 2007 9:40 am

by Paul King

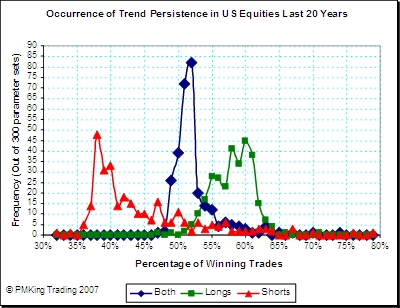

The chart above shows the difference in up and down trends for liquid US equities over the last 20 years. Note that due to survivorship bias companies that have trended down to zero are not included. There is still a big difference in how equities move up to how they move down even accounting for this bias.

The data was generated using Trading Blox builder by defining a trend as an X ATR(Y) move over Z days and then examining the price T days later to see if it was up or down. 300 different parameter sets for X, Y, Z and T were used and the win% of each system instance applied to a list of liquid US equities was plotted on the frequency distribution.

My conclusion: what goes up usually goes higher, but not necessarily vice versa.