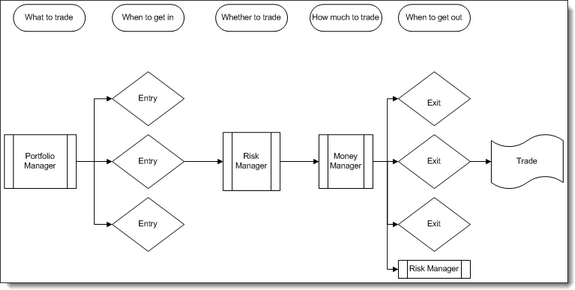

Process Flow

It helps to think of Trading Blox in terms of a process flow where the individual Trading Blox are part of a larger process which determines which markets to enter and when to exit positions, the system.

Starting with the entire portfolio of available markets, the Portfolio Manager Block filters those markets to determine which ones are available for trading on a given day, the Entry Blox create entry orders when the systems entry conditions have been met. Once an entry order has been created, the Risk Manager Block determines whether or not a particular order should be taken by assessing its affect on overall risk. If the Risk Manager Block determines the trade should be taken, the Money Manager Block looks at entry risk and other market factors to determine the size of the order (i.e. number of shares or contracts).

Orders that result in fills based on the subsequent market pricing will result in simulated positions. For each market that has a position on a given day, Trading Blox calls the Exit Blox to create potential exit orders. The Risk Manager Block is also given a chance to reduce position size or change stops each day in response to overall market risk.

Edit Time: 9/12/2020 10:28:46 AM |

Topic ID#: 475 |